In today’s scenario, social media is no longer an option for insurance agents but it’s a game-changer for them. Insurance agents can grow their business 10x with the right kind of strategies and the best part is without spending a lot of money! You can build trust, generate leads, and grow your business. This blog is a complete guide to social media marketing for Insurance agents. We will cover everything you need to know about social media marketing and how to make use of the right social media platform for maximum results!

How To Market Insurance on Social Media?

Insurance agents need a well-planned strategy to use social media for marketing Insurance. Social media has become more than just posting about random things. It is more about engaging potential clients, educating them, and building trust and credibility. Below are the important steps for insurance social media marketing, that we will explore one by one, later in this blog! Check out this blog for the best insurance ad examples!

- Identify your target audience

- Choose the right social media platforms

- Optimizing your social media profiles

- Effective content strategy

- Generating leads through social media

- Paid advertising

- Posting frequency and best practices

- Track Performance through analytics tools

- Know about the compliance & Industry Regulations

1. Know Your Audience

Understanding your audience is the basic step of a successful social media strategy. Who needs your services? What are their concerns? How do they consume information? Research your audience’s demographics, behaviors, and preferences to tailor your content accordingly.

Setting Clear Goals

You need to define clear end goals before doing social media marketing. This makes it easy to tailor your social media marketing campaigns. You need to be aware of your end goal: are you looking to generate leads, increase brand awareness, or establish authority? Below are some goals for Insurance agents:

- Increasing Website Traffic: You can do this by sharing and posting content that gives some value and have strong CTAs.

- Growing An Engaged Follower Base: This is possible by consistently posting and keeping your followers engaged by ineracting.

- Converting Social Media Inquiries Into Clients: Always be quick to respond. You can also use lead forms.

- Establishing Thought Leadership In The Insurance Industry: Share industry knowledge, trends and quick tips.

- Improve Customer Retention: by actively involving with them and always keeping them updated.

2. Choose The Right Social Media Platforms (With The Best ROI)

Not every platform works the same for insurance agents. Some offer better engagement and ROI than others. The best social media platform for ROI (Return on Investment) for insurance agents depends on your goals, audience, and marketing strategy. However, based on industry trends and lead conversion rates, Facebook and LinkedIn offer the highest ROI.

Here’s how to choose the best platform for your business:

1. Facebook

Best for lead generation, community engagement, and targeted ads. Facebook remains one of the most effective platforms for insurance agents because it has a vast user base and advanced targeting options. Through Facebook, you can do the following:

- Run lead generation ads to capture potential clients’ contact information, use contact enrichment to add valuable insights, and collect other relevant details.

- Build a community through a Facebook Group where you offer insurance tips and answer any questions.

- Use Facebook Live to host Q&A sessions, share industry updates, you can also explain policy benefits in real time.

- You can post engaging content, such as client testimonials, educational infographics, and insurance guides.

- Use Facebook Messenger bots to automate your responses to streamline your interactions with the customers.

2. LinkedIn

Ideal for networking, B2B marketing, and positioning yourself as an industry expert. LinkedIn is a professional networking platform that helps insurance agents to connect with business owners, corporate clients, and industry leaders. Here’s how to maximize ROI:

- Optimize your LinkedIn profile to showcase your expertise, credentials, and services.

- You can establish your authority by sharing your thoughts on leadership articles and giving insurance insights.

- Use LinkedIn Groups to join discussions and answer insurance-related queries.

- Run LinkedIn Ads to target professionals who may need business insurance or employee benefits.

- Send personalized InMail messages to build relationships with your potential clients.

3. Instagram

Great for storytelling, branding, and reaching a younger audience. Instagram is a visual platform that allows insurance agents to humanize their brand and connect with a younger, tech-savvy audience. Make the most of Instagram by:

- Sharing behind-the-scenes content. You can showcase your personality and work culture to your target audiences.

- Posting carousel posts to simplify complex insurance topics into easy-to-digest slides and in simpler way.

- You can share quick tips, policy benefits, and industry trends through Reels and Stories.

- Using polls, quizzes, and AMA (Ask Me Anything) sessions to increase user engagement.

- Highlighting client success stories and testimonials in Instagram Highlights, will help you to showcase your social proofs.

4. YouTube

Perfect for educating potential clients with video content. YouTube is a powerful platform for long-form content. Youtube can be used if you want to educate your potential clients. Here’s how to use it effectively:

- Create videos by explaining different types of insurance in simple terms, without using industry jargons.

- Upload client case studies to showcase real-life examples, where people can see how insurance has helped many others. This helps in building trust.

- Share step-by-step guides on filing claims, choosing the right policies and decoding premium insurances.

- To increase your organic traffic, you can use SEO by optimizing your video titles, descriptions, and meta tags.

- To engage with your potential clients you can host live webinars and Q&A sessions.

5. Twitter/X

Useful for industry news, updates, and quick engagement. Twitter/X is great for sharing quick updates and engaging with a broad audience in real time. To use it effectively:

- Share insurance news, policy updates, and industry trends in short and concise tweets.

- You can use Twitter Polls to better understand your potential clients and also know what they look for in an Insurance policy.

- Engage in hashtag conversations that are related to finance, insurance etc.

- Retweet and comment on relevant posts from industry experts, news sources, and satisfied clients.

Stand Out on TikTok with AI Content 🌟

3. Optimizing Your Social Media Profiles

Your social media profiles are what your potential clients see, when they search about you or your brand niche. Hence, you need to make sure your profiles reflect your professionalism and credibility.

How to Set Up Social Media Profiles?

- To set up your social media profiles, you need to choose the right social media platform, based on what we have discussed above.

- After creating your account, add complete business details such as profile picture, bio, contact information etc.

- After choosing the right platform, start by creating your business profiles/page. For creating a business page, follow the steps shared here: LinkedIn Page, Instagram Business Profile.

- Next step involves how to properly optimize your social media profiles!

How To Optimize Social Media Profiles?

- You should always stick to a clear, high-quality profile picture, preferably a professional headshot.

- Write a compelling bio that highlights your expertise and services.

- Include contact details and a call-to-action (CTA).

- Pin important posts, such as testimonials or educational content.

- Use consistent branding across all platforms. This builds your brand voice and identity. Check out: How to create a brand identity on Instagram?

4. Content Strategy for Insurance Agents

For insurance brokers, effective social media marketing is mostly dependent on a solid content plan. It creates leads, helps educate possible customers, and builds trust. The secret is to produce for your audience worthwhile, interesting, and simple information for easy grasp and understanding. You can create below various types of high-performing content for Insurance agents:

1. Educational Posts

Explain insurance policies in simple terms to your users. This will help them to understand the complex information related to this industry. You can post:

- Videos and posts to explain difficult industry jargons and various Insurance policies.

- Make use of infographics and checklists.

- You can also post market trends and updates.

- Address common insurance misconceptions through FAQs.

Educational content generates 3x more leads than traditional marketing. About 90% of consumers trust businesses that provide helpful content over direct advertising.

2. Client Success Stories

Share testimonials and real-life examples. This builds trust and authenticity.

- You can post about client reviews along with a personal story.

- Short video clips about a satisfied client.

- You can post about case studies, before and after scenarios.

Video Testimonials tend to increase the conversion rates by 80%. Positive testimonials increase a consumer’s trust by a large margin.

3. Behind-the-Scenes & Personal Branding

Show the human side of your business. You can post about:

- BTS scenes, sharing office culture, team events etc.

- You can personalize the content by sharing your personal story. Why did you become an Insurance agent, what’s the story behind etc.

- You can post about your daily routine.

Humanizing content increases the chances of a brand recall. Posts with real people perform better than the stock images and build trust. By running your captions through Humanizer AI, you can make sure your words feel just as genuine as the moments captured in your photos and stories.

4. Engaging & Interactive Content

Social media favors content that is engaging and sparks interaction.

- You can do this through polls, quizzes, AMA (Ask Me Anything) stories, Live Q&A sessions.

- You can encourage participation through challenges and giveaways.

This type of content generate twice the engagement as compared to static posts.

5. Generating Leads through Social Media

Social media can be a powerful lead-generation tool if used correctly. Beyond offering free guides and running ads, consider how conversational AI for insurance companies can be integrated into platforms like Facebook Messenger to qualify leads and provide instant support. Here are some proven methods:

- Offer free guides, checklists, or consultations in exchange for contact details.

- Use lead-generation ads on Facebook and LinkedIn.

- Run referral programs that encourage existing clients to recommend your services.

- Host live Q&A sessions to engage potential clients.

6. Paid Advertising

Paid ads help you to reach a targeted audience in a much faster way. Below are some social media ads that prove to be very effective for Insurance agents:

- Facebook & Instagram Ads: They are ideal for targeted lead generation.

- LinkedIn Ads: are best for connecting with professionals and business owners.

- YouTube Ads: are great for video marketing and brand awareness.

- Retargeting Ads: help to re-engage visitors who have interacted with your content before.

7. Posting Frequency & Best Practices

In today’s scenario, consistent posting has become difficult, hence by making use of a content calendar you can schedule your posts before hand. A content calendar helps you to plan and schedule posts in advance, ensuring consistency and variety in your social media strategy. It keeps you organized, helps track key dates, and aligns content with business goals.

Follow the below recommended posting frequency for boosting visibility and engagement.

- Facebook: 3-5 times per week in the form of videos, testimonials, lead ads.

- LinkedIn: 2-4 times per week through articles, thought leadership posts.

- Instagram: 4-7 times per week as stories, reels, carousels.

- YouTube: 1-2 times per week (educational videos, client case studies).

- Twitter/X: Daily updates, quick insights, and engagement with trending topics

8. Track Performance Using Analytical Tools

By monitoring data through the below mentioned analytical tools, you can track the performance of your brand on social media. This way you will understand what’s working with your target audience and what needs improvement.

- Use Facebook Insights to track user engagement, measure your audience’s reach, and analyze conversions in an effective way.

- You can make use of LinkedIn Analytics to evaluate post performance and assess lead generation success.

- You can regularly monitor Google Analytics to track website traffic driven by social media platforms. Utilize Instagram and Twitter/X Analytics to gain valuable audience insights and measure content performance.

9. Compliance & Industry Regulations

You need to make sure that your social media activities always comply with legal and ethical guidelines, as Insurance is a regulated industry. You should never make misleading claims and make sure that client information is confidential.

Social Media Management Tools For Insurance Agents

You can use the below mentioned tools to manage and enhance your social media content:

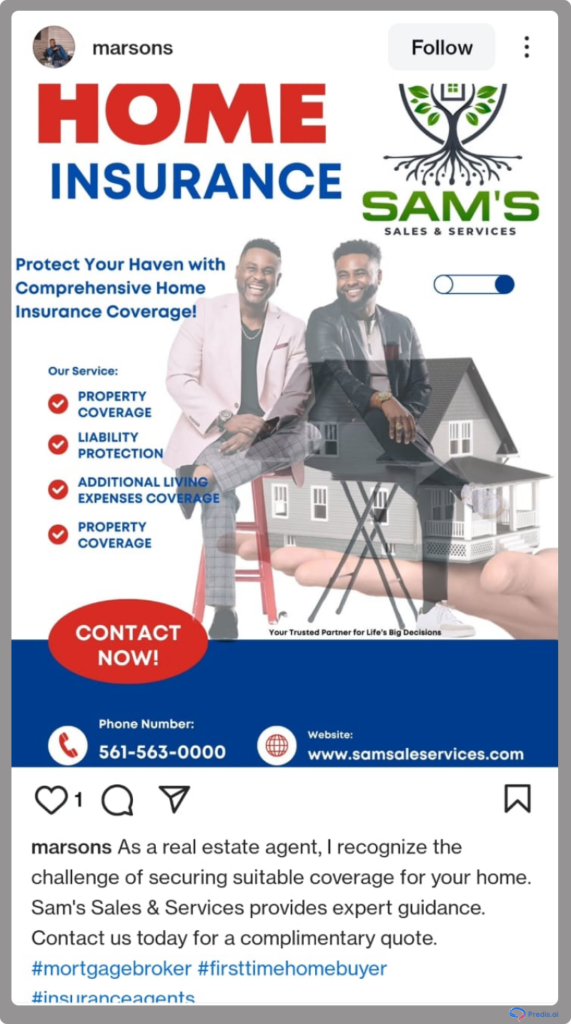

- Predis.ai: is a social media management tool, that uses AI to create social media content instantly. You can do competitor analysis, schedule your posts, create banner/display/videos ads and much more!

- Canva can be used for creating visually appealing content.

- Hootsuite or Buffer for scheduling and managing posts.

- Facebook Ads Manager for running paid campaigns.

- Google Analytics for tracking traffic and performance.

- Chatbots like ManyChat and AI phone agents like Goodcall for automated responses to the user.

Conclusion

Social media marketing can be a strong tool for insurance agents if used wisely. Understand your viewers, create useful content, engage regularly, and use paid ads if needed. Keep track of your progress, change your plan if needed, and build trust to achieve lasting success.

Begin using these techniques today and see your insurance business thrive!