The financial services market is on an exciting trajectory, growing from USD 25.51 trillion in 2022, with projections suggesting it will more than double (58.69 trillion) by 2031. You will be astonished to know that nearly a quarter of the global economy is tied to financial services, as highlighted in the International Monetary Fund’s World Economic Outlook report.

Total giving reached $557.2 billion in 2023. This demonstrates the vast scale of financial transactions and the potential for financial services businesses to engage with a wide audience, especially through effective social media marketing.

As the financial services market continues its impressive growth, so too do the number of businesses vying for attention. In such a competitive environment, distinguishing your financial services business is imperative for long-term success. But how do you do that? To make sure your financial services business stands out and achieves sustainable growth, a strategic social media marketing approach is a must-have.

Let’s take a look at some of the best, tried-and-tested finance social media marketing tips and tricks for enduring business growth.

A Quick Glance at Financial Services and What They Entail?

When we think about financial services, we see them as the backbone of our economic activities. They encompass a wide range of services and products designed to manage money. Fundamentally, financial services cover banking, savings accounts, investments, insurance, wealth management, tax planning, and retirement funding.

For example, when we deposit our paychecks in the bank, we’re using a financial service. If we decide to buy stocks, compare fixed income investments, or bonds, we’re engaging with investment services that increasingly rely on secure digital platforms built through Financial Software Development services. If we need to secure our future against uncertainties, insurance services come into play. Even managing our credit cards and loans falls under the umbrella of financial services. These services are integral to our daily lives since they help us save, invest, and grow our wealth. Behind these services are secure digital platforms built by finance software developers. They enable scalability, compliance, and a smoother customer experience. Many providers work with an insurance software company to streamline operations and enhance service delivery.

Whenever we discuss financial services businesses, names like JPMorgan Chase, Goldman Sachs, and Allianz naturally come to mind. These are globally renowned financial services businesses that provide banking and investments, financial advisory and investment banking, as well as insurance services, respectively. Many of these institutions are also investing heavily in digital banking development services to meet evolving customer expectations and remain competitive in the era of fintech disruption.

Getting Started with Financial Social Media Advertising

Over 80% of financial marketers report that they have gained new leads through social media marketing. Clearly, we cannot afford to miss out on this opportunity to attract and engage potential clients.

Here’s a roadmap to get started with financial social media advertising:

1. First Step is to Understand Regulatory Constraints

The financial services sector is highly regulated and comes with strict regulatory and compliance guidelines as per national and international law. As a business in finance services, we must start by getting acquainted with these regulations and compliance requirements for financial advertising on social media.

The general rule of thumb is to avoid making misleading claims, maintain transparency, and follow industry guidelines. When we adhere to these rules, it helps us avoid penalties and build trust with our audience.

2. Next, Pinpoint and Segment the Target Audience

Among all social media platforms, LinkedIn stands out as the top choice for advertising a financial services business. Also, 4 out of 5 content marketers say LinkedIn ads produced the best results as compared to other social media platforms. This is mostly because of its professional user base and more sophisticated targeting options.

1. Define Advertising Goals

To effectively pinpoint and target your audience on any social media platform, you have to start by defining our advertising goals. You have to be very specific about the goals we choose because they will ultimately influence the type of content you will be creating for advertising. Ideally, most businesses want to increase their brand awareness, generate leads, or drive traffic to their websites.

2. Research and Create Detailed Audience Segments

The next step is to Identify our ideal client profile. You can do so by researching key demographics like job title, industry, company size, income level, and location. You can then have to understand their interests, pain points, and what they value in financial services. This research approach is equally valuable for professionals exploring social media for accounting, as understanding client needs is fundamental across all financial disciplines.

Let’s assume you have chosen LinkedIn as our preferred social media marketing platform. Thus, you can utilize LinkedIn’s targeting options to define your audience segments.

Here’s what you have to focus on:

- Job Titles and Roles: Target specific roles relevant to our services, such as CFOs, financial planners, or wealth managers.

- Industries: Select industries where our financial services are most applicable, such as banking, insurance, or investment management.

- Company Size: We must tailor our advertising message to small businesses, mid-sized companies, or large enterprises, depending on our target market.

- Geography: Narrow down to regions, countries, or cities where we want to focus our financial social media advertising efforts.

3. Engage the Audience with Relevant Content

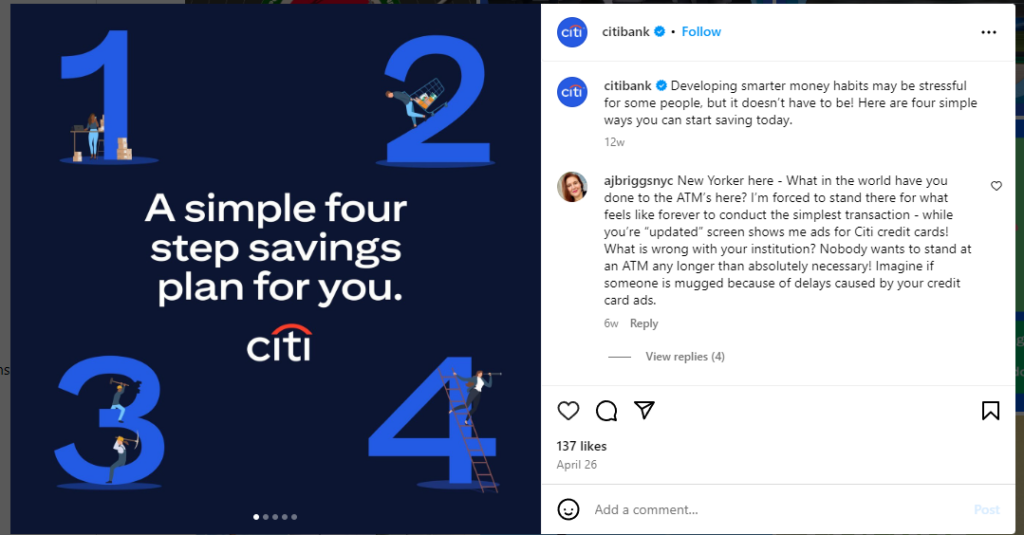

Once you have successfully segmented our target audience, you have to constantly engage with them through social media ads and posts. Financial services businesses can do this by creating educational content around their services and pushing it on all their social media channels. Businesses must also use client testimonials and success stories in their ads and posts to attract potential customers.

Once again, it is important to note that any financial advice should be given with proper consideration of regulatory requirements, transparency, and ethical standards to avoid any legal issues, misunderstandings, or damage to client trust.

3. Retarget the Prospective Clients

Retargeting is an important aspect of financial social media advertising strategies. It is for re-engaging individuals who have previously interacted with our content or visited our website but did not convert initially. By keeping our services in their minds, we actually motivate them to take action.

Retargeting works because it focuses on people who have already shown an interest in what we offer. For example, if someone visits our site and browses through our financial planning services but leaves without signing up, we can retarget them with personalized ads that remind them of the benefits they were considering. The strategy of retargeting increases the likelihood of converting these warm leads into clients.

Content Ideas for Finance Social Media Marketing

Organic social media marketing is free and a more sustainable option for the long term. This might be a bit surprising but 21% of marketers reported that they generate the most leads through organic social media marketing.

Therefore, before jumping into paid social media marketing efforts like ads, we must focus on growing organically. The key is to create crisp, relevant, and insightful content for social media platforms.

Remember, not all types of content work on every platform. Short videos are best for Instagram, TikTok and LinkedIn, while long-form content is ideal for YouTube. Similarly, bite-sized content is best for targeting viewers on X.

Let’s take a quick look at the types of content we can develop to provide valuable information and build a loyal following on social media platforms:

1. Market Analyses and Reports

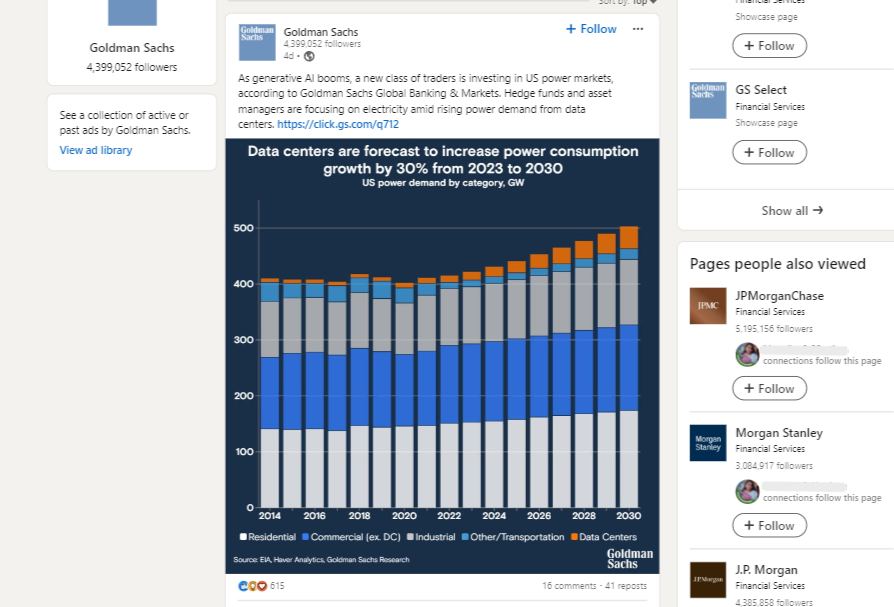

We can regularly publish detailed market analyses that offer insights into current financial trends, economic forecasts, and market movements, including emerging sectors such as the life settlement market, to position your brand as an authority in forward-thinking financial solutions.

This type of content helps our audience stay informed about the latest developments and make well-informed investment decisions. Detailed reports, as shown in the image below, with data visualizations, charts, and expert commentary, can significantly increase the value of our posts.

2. Investment Tips and Strategies

Sharing actionable investment tips and strategies can attract both novice and experienced investors. We can create content that covers various investment topics, such as portfolio diversification, risk management, and emerging investment opportunities.

Look at the example of a carousel post from Goldman Sachs. In this post, they have provided some deep insights into the consumer stocks that investors are interested in for the next half of 2024. To help your audience make informed decisions, you can also provide tools and insights that allow them to track top investors’ portfolios, following proven strategies and market moves.

3. Financial Planning Guides

We can develop comprehensive financial planning guides that cover essential topics like retirement planning, tax optimization, estate planning, and budgeting. We can develop comprehensive financial planning guides that cover essential topics like retirement planning, tax optimization, estate planning, budgeting, and business loans for women.

We can break down complex financial concepts into easy-to-understand guides and present this content as blog posts, downloadable PDFs, or interactive webinars. Incorporating an expense report software guide can further help readers apply these strategies effectively in real-world financial management. Additionally, using Suplari’s spend analysis software can provide businesses with deeper insights into their financial operations, making it easier to manage budgets, track expenses, and support smarter decision-making.

4. Case Studies and Success Stories

Showcasing real-life examples of clients who have successfully used our services can build trust and credibility. We can create case studies that highlight the challenges our clients faced, the solutions we provided, and the positive outcomes they achieved. These stories resonate with potential clients by demonstrating tangible benefits and success.

5. Educational Videos and Webinars

Videos, podcasts and webinars are excellent tools for delivering educational content. We can create short explainer videos on specific financial topics or host live webinars where we discuss market updates and investment strategies, and answer audience questions.

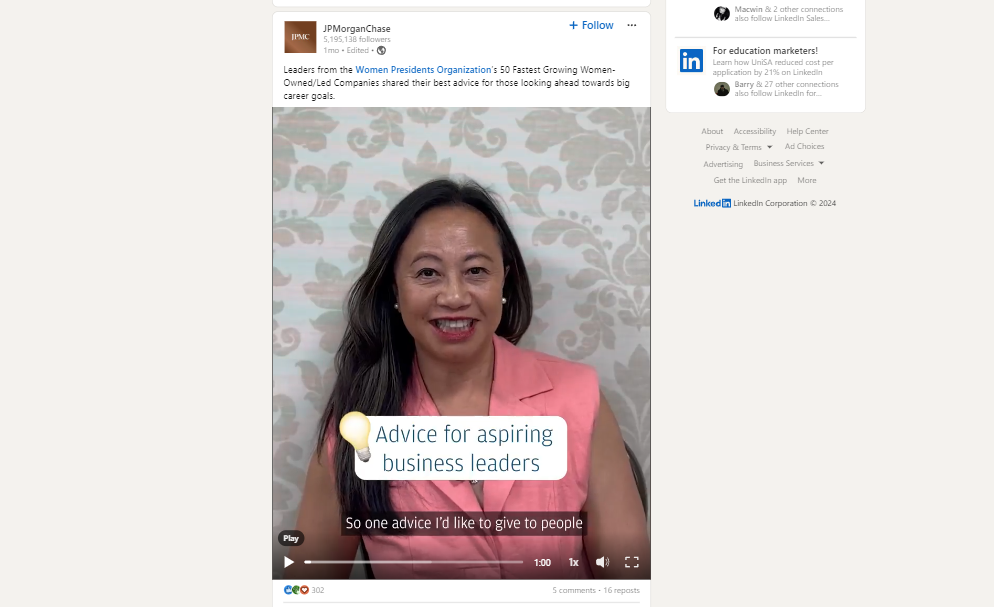

6. Expert Interviews and Guest Posts

Featuring interviews with financial experts or guest posts from industry leaders can add depth and variety to our content. We can invite well-known figures to share their insights on current financial trends, investment strategies, or regulatory changes.

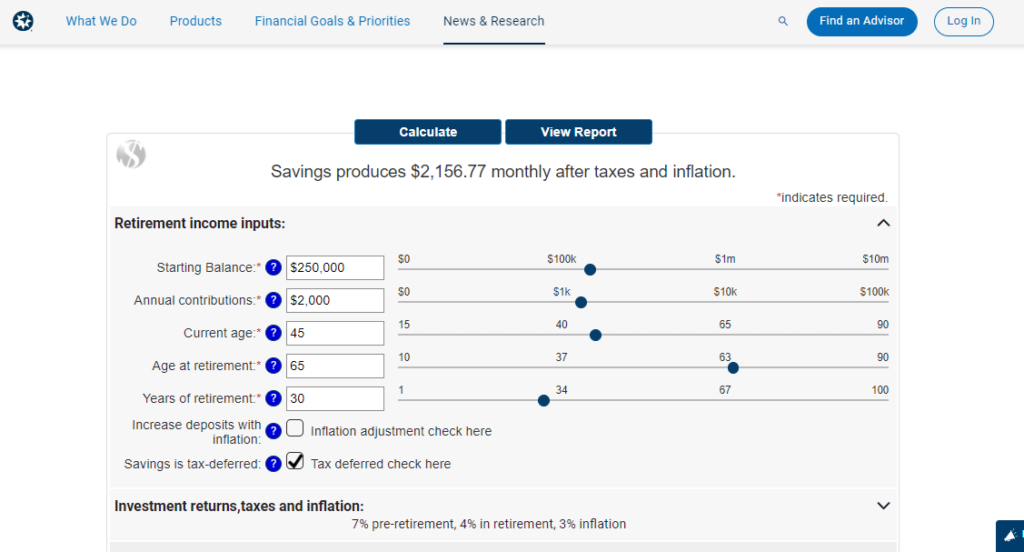

7. Interactive Tools and Calculators

One of the best ways to engage prospective clients is by developing interactive tools, such as investment calculators, retirement planning simulators, or risk assessment questionnaires. Many financial services businesses are using such tools to engage their audience, provide personalized insights and then very subtly push their financial services based on the user’s unique situation and goals.

Shown in the picture is the retirement income calculator by Ameriprise Financial. To promote a similar tool on our social media handle, we can simply put up a post with a CTA ”Secure Your Future! Use Our Retirement Calculator to See How Much You Need to Save. Start Now!”

Why Should You Utilize Paid Social Media Channels for Financial Services Marketing?

While organic growth is valuable, paid advertising like LinkedIn Ads, Facebook Ads, etc, brings a host of benefits that can really make a difference for financial services businesses.

For starters, it lets us target our ads based on specific details like who our audience is, where they live, and what their interests are. Consequently, our ads reach the people who are most likely to be interested in what we offer, making our efforts more effective.

The evolution of these tools means that modern marketing efforts now leverage sophisticated AI agents for marketing to automate creative generation, hyper-targeting, and performance optimization.

Another advantage is the ability to see how well our ads are performing in real-time, i.e. we gain access to measurable metrics. By keeping track of metrics like click-through rates, conversion rates, and return on ad spend, we can see which ads are working and make adjustments as needed.

Paid ads also provide flexibility. Unlike organic methods, which can take time to build up, paid ads can be scaled up quickly to meet our marketing needs. All these reasons do sound pretty lucrative and hence investing in paid-financial social media marketing becomes a smart move to stand against other similar businesses. Behind many of these campaigns lies robust fintech software development, which enables secure transactions, real-time data processing, and the digital infrastructure required to support modern financial products.

Finance Ad Ideas for Financial Services Businesses

Take a look at some impactful finance ad ideas for social media platforms like Facebook, Instagram, and LinkedIn.

1. Facebook Ads

Look at these Facebook ad ideas for your finance services businesses:

- Educational Content Ads: Create ads featuring educational content like investment guides, retirement planning tips, or market analysis reports. Use eye-catching visuals and concise copy to highlight the value of the content. For example, an ad could promote a downloadable guide on a particular topic with a clear CTA to download the guide.

- Client Success Stories: Showcase testimonials and case studies from satisfied clients. This type of social proof builds credibility and trust. A Facebook ad could feature a short video of a client sharing their positive experience and the results they achieved with your services.

- Lead Generation Ads: Take advantage of Facebook’s lead generation ad format to capture contact information directly within the platform. Offer a free financial consultation or an exclusive report in exchange for contact details. An ad like this would simplify the process for potential clients and increase conversion rates.

Predis.ai’s Facebook ad maker can help you create custom creatives and captions based on your text input. Try it now!

2. Instagram Ads

You can also increase the ad recall rate for your ad campaigns by inculcating Instagram’s reel and carousel ads.

Consider these financial Instagram ad ideas for your next social media campaign:

- Short Videos and Reels: Make use of Instagram’s video features to share brief, engaging financial tips or quick market updates. Short, visually appealing videos can quickly grab attention and drive engagement.

- Carousel Ads: Use carousel ads to present a series of images or slides that detail various aspects of your services. For example, a carousel ad could showcase different retirement planning strategies, with each slide highlighting a unique benefit.

- Interactive Stories: Create Instagram Stories with interactive elements like polls, quizzes, or Q&A sessions. These features encourage user interaction and can be used to gather insights about your audience’s financial interests and concerns.

3. LinkedIn Ads

Take a look at these ad ideas that work best for LinkedIn.

- Sponsored Content: Share in-depth articles, whitepapers, or industry reports through LinkedIn’s Sponsored Content format. Sponsored content on LinkedIn positions your business as a thought leader and engages professionals interested in financial insights.

- Text Ads: Utilize LinkedIn’s text ads for straightforward, concise messaging. Highlight key services or offers in a brief, attention-grabbing format. For example, a text ad could promote a free financial audit with a strong CTA to “Schedule Your Audit Today.”

- InMail Campaigns: Send personalized messages to LinkedIn users directly through Sponsored InMail. To make it more effective, you can customize your message to address specific financial needs or offer a personalized consultation. This approach allows for direct engagement with potential clients.

Takeaway

Financial social media advertising can take your business to new heights. However, the key to success lies in segmenting your target audience and choosing the right content type for each social media platform.

One can always prioritize one social media platform over the other based on their target audience niche. For example, if you want to market your financial services to millennials, Facebook should be your ideal choice. But if your target audience is Gen Z, Instagram and TikTok would work better for you.

The key takeaway is that content is the king. That means your financial social media advertising efforts will work or not; it depends largely on the type of content you are creating and sharing with your audiences. This is especially critical for businesses in the finance sector.

Use Predis.ai’s Social Media Post Generator to create visually appealing content and highly converting ads today!