As a finance influencer, providing credible and reliable content to followers is important, as it can help you gain clients and establish yourself as an authority in the industry. Social media platforms can be a great way to find opportunities as a financial advisor, and creating content can be a fun and engaging activity.

But creating content is no longer fun if you are unable to generate new ideas for your audience. If you feel your content is unsatisfactory or fails to generate content ideas for your pages. You are not alone; we all have been there. To make your content that the audience will love, here are top social media post ideas for financial advisors:

Top 30 Social Media Post Ideas for Financial Advisors

Social media might not feel like the natural playground for financial advisors, but here’s the truth: your clients and prospects are already there, scrolling, searching, and looking for guidance they can trust. The challenge isn’t whether you should show up, it’s how to share content that positions you as credible, approachable, and valuable without sounding overly technical or promotional.

That’s where having the right post ideas comes in. To make it easier, we’ve pulled together 30 practical, high-impact social media post ideas tailored for financial advisors. These will help you educate your audience, build trust, and stay top of mind whether you’re posting on LinkedIn, Instagram, or anywhere your clients spend their time.

1. Financial Quotes

Quotes can not be missed from the content strategy of any Instagram page, providing an incredible opportunity to engage with the audience. Even if quotes are not niche-specific, they make an easily consumed content idea.

With quotes, bringing up new content for your audience is quick, easy, and simple. Another interesting benefit is that people often share quotes in their stories or among their social circles. This only increases the reach of your finance social media accounts.

The use of well-researched hashtags along with good quotes will facilitate the introduction to the new audience. When you include quotes in your social media strategy, ensure you provide your audience quality and focus on your niche.

Use Predis.ai’s “Quotes to Post” feature to create social media posts in an instance. Transform your Facebook feed with compelling posts crafted easily using Predis.ai’s Facebook Post Maker.

2. Investments

Investment management is one of the key roles of financial advisors. This makes investment a must-include topic for social media post ideas for financial advisors. To start with the investments as a content idea, you can build your content from investment basics. Try including the benefits of the same in your posts.

Talk about investing in real states, ETFs, Index funds, cryptocurrencies, or startups. Additionally, curate an investment guide and create social media posts that revolve around the same. With your content, you will be able to help your audience to track, analyze, and upgrade their investment management.

3. Taxes & Planning

Tax planning can be difficult, but content ideas that simplify it are not! If you are a financial advisor, provide valuable knowledge to your audience by sharing information about tax planning in a way it gets easier to understand. For example, explaining strategies like the Augusta Rule, which allows business owners to rent their homes to their businesses for meetings. For up to 14 days, this rental income can be tax-free, offering potential savings of over $10,000, depending on local rental rates and tax brackets.?

Create carousels over FAQs, tax-saving strategies, tax-planning tips, the eligibility requirements for the child tax credit, and top mistakes to avoid in your content for social media. Sharing client stories featuring effective tax planning can be one way to persuade your audience using content towards tax planning.

4. Insurance

Next on our list of social media post ideas for financial planners are insurance topics. Insurance is a crucial financial tool that provides protection against potential risks and uncertainties.

While it may seem complex at first glance, breaking down the basics can help individuals gain a better understanding of this important concept. To start with insurance as one of the content sub-parts, begin by explaining the basics of it.

Cover posts that educate the audience with the basics. Further, try to proceed with different types of insurance like health insurance, funeral insurance, life insurance, home insurance, etc. One easy and simple content idea is to simplify the claim process, insurance policy evaluation, and risk management for your audience.

If you want to target a specific audience, try creating content that talks about a specific group of people. For example, a content piece that shares valuable insights about insurance policies for small businesses will target owners of small businesses.

5. Financial Literacy for Common People

This content idea for Financial Advisors can alone be one of the content pillars of your content strategies for your finance page. For a weekly post, introduce a difficult jargon or concept in a simpler way that targets common people.

For people willing to strengthen their finance basics, create a post suggesting books and education resources (links to reputed websites, podcasts, courses, YouTube channels, etc.).

To better understand your audience, you can also create a quiz to help you understand the type of content you should deliver.

6. Savings

An important content idea for a financial planner is posting about savings. Cover content for audiences with different financial conditions and circumstances.

Saving money is a fundamental aspect of financial success and security. Whether you’re just starting your financial journey or looking to improve your existing saving habits, understanding different strategies tailored to various financial conditions and circumstances can make a significant difference.

How a middle-class man saves money will be entirely different from how a rich person does it. A saving challenge (30-day saving challenge or no weekend spend challenge) for your audience is one intriguing way to increase engagement by letting your audience participate in it.

7. Savings for College Students

As a financial advisor, your content targeted at college students can be valuable. For targeting college students, create content that speaks of ways to strategize budget and college money-saving tips.

For example, students aspiring to pursue higher education are always looking to find ways to fund their college expenses. Providing your audience with information about part-time jobs can be one of the most insightful social media post ideas for financial advisors.

Create posts about time management and ways to balance both work and academics. Refinance student loans, frugal living, and money-saving strategies are some of the best ideas for Financial Advisors.

8. Retirement Planning

Retirement is a milestone that requires careful planning to ensure financial security and a fulfilling lifestyle in your golden years. As a financial advisor, providing valuable insights and strategies to your audience regarding retirement planning can be immensely beneficial. Let’s delve into the essential aspects of retirement planning to help individuals make informed decisions for a prosperous future.

Start by explaining the basics of retirement savings plans, such as Individual Retirement Accounts (IRAs), 401(k) plans, and pension

schemes.

You can also talk about retirement income sources, retirement withdrawal strategies, and healthcare for retired people. Target retired individuals or people who are retiring soon.

9. Habits to Save Money

As a finance advisor, your content can revolve around financial advice that guides the audience to save money. Talk about how the expenses can be monitored and tracked. Another highlight for this topic can be automated transfer to the savings account. Our wants often lure us, but that sometimes makes us spend more.

Help your audience to prioritize needs over wants and help them save in the long run. Encourage your audience to cancel unused subscriptions. When considering money-saving habits, repurposing and DIYs can also be extremely beneficial. This allows new people to recognize and reach your content. Create separate posts for each of these topics.

10. Stock Market

The stock market has seen a rise, and people are stepping forward to go in-depth into stock concepts. But the stock market is not easy. So, it’s important to educate your audience about the stock market basics.

Talking about stock market concepts like stock, indexes, bonds, and market fluctuations is one of the best social media post ideas for financial advisors. Strategies for investing in the stock market are another way to create valuable content for your audience.

Market updates, investment research tips, stock analysis, and investment platforms are some of the other ways to create content about the stock market.

11. Market Trends

If you want to be consistent with your social media content, talking about market trends will never leave you with an absence of content. Beyond traditional market indicators, consider covering emerging asset classes—such as longevity-based investments, which analyze demographic and actuarial data. For experts, you can make it a go-to place for all the recent trends in the finance market.

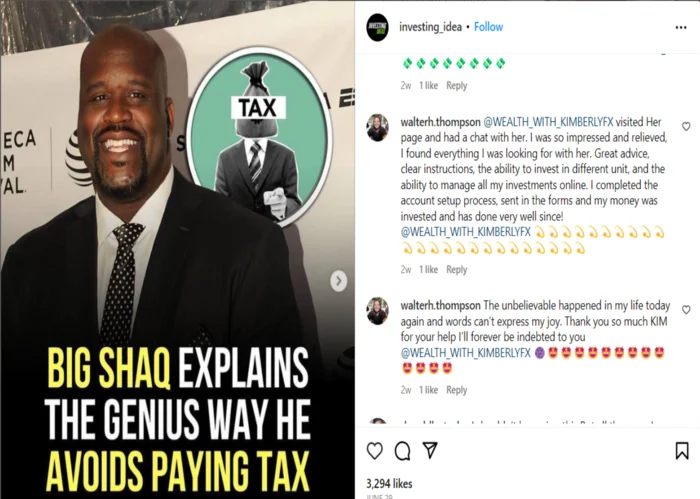

12. Client Success Stories

The best way to earn the trust of your audience is by sharing real-life success stories as your content. Share a small clip posting client testimonials.

Case studies are another great way to show how your strategies helped the clients to achieve their financial goals and achievement stories. Success stories that involve successful retirement planning, investment success stories, debt payoff, etc., can be used as finance content ideas for your social media channels.

As a financial advisor, sharing stories and testimonials from your followers who have benefitted from your guidance can highlight the positive impact of financial education.

13. Myths About Investing

Next on the list of social media post ideas for financial advisors are myths about investing. When it comes to making financial decisions, people are often bound by misconceptions and myths. Create content that helps in making informed financial decisions by debunking financial myths. When it comes to making financial decisions, we are often bound by misconceptions and myths. Create content that helps in making informed financial decisions by debunking financial myths.

Start with a weekly series where you debunk financial myths for your audience. Create a series of posts that compares myths with realities. One fun way to engage your audience is by creating a quiz for facts and fiction. Add myths covering finance’s important domains like retirement, budgeting, credit score, etc.

14. Ask Questions & Create a Post

Let’s face it, we all have those lazy days when our motivation levels are at an all-time low. However, even during these moments, leverage your audience’s creativity and engagement to gather ideas for your next post.

Why is this content idea a hit?

It increases the engagement of your audience. Additionally, you can get to know what your audience needs. It is always better to serve what’s been asked for! And with this idea, you get to relax (just so you put in more effort in curating the best posts once you get the ideas, soft grin!)

Design stunning posters that leave an impression with Predis.ai’s AI Poster Maker for Social Media—perfect for ads, promotions, and more.

15. Give Your Audience Humor

Adding a pinch of humor to your posts is the best way to engage with the audience. Light-hearted finance-related memes that incorporate financial situations and money-saving strategies can be the best to cover in your content.

Financial puns, cartoon strips, jokes, and GIFs are a few other ways to make your finance content fun to read.

16. Credit Score Management

Maintaining a good credit score is crucial for financial health, yet many people are unaware of how to manage it effectively. Use your social media platforms to educate your audience on the factors that influence credit scores, such as payment history, credit utilization, and length of credit history.

Create informative graphics and carousels that explain how to check credit scores, the importance of monitoring credit reports, and tips for improving and maintaining a high credit score. Discuss the impact of credit scores on loan approvals, interest rates, and even job prospects.

You can also address common misconceptions about credit scores, such as the belief that checking your own credit score will lower it. By providing clear and accurate information, you can help demystify this often misunderstood aspect of personal finance.

17. Debt Management Strategies

Debt can be a significant burden, but with the right strategies, it can be managed and even eliminated. Share content that guides your audience through various debt management techniques. Social media post ideas for financial advisors could involve explaining the pros and cons of methods like the snowball and avalanche approaches to paying off debt.

Create posts that offer advice on consolidating debt, negotiating with creditors, and understanding the difference between good debt (like mortgages) and bad debt (like high-interest credit card debt). Sharing real-life examples of people who have successfully paid off their debt can motivate and encourage your followers.

Additionally, provide tips on avoiding debt traps, such as payday loans or high-interest credit cards, and offer alternatives like emergency funds or low-interest personal loans.

18. Financial Goal Setting

Setting financial goals is a key step toward achieving long-term financial success. Use your social media platforms to help your audience understand the importance of setting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial goals.

Create content that walks your followers through the process of setting short-term and long-term financial goals. Provide examples of common financial goals, such as building an emergency fund, saving for a down payment on a house, or planning for a child’s education.

You can also share tools and templates for goal setting and encourage your audience to share their own goals and progress. This not only fosters a sense of community but also provides accountability and support.

19. Navigating Financial Crises

Financial crises, whether personal or global, can be challenging to navigate. Use your expertise to guide your audience through these tough times. Share content on how to prepare for economic downturns, such as building an emergency fund, diversifying investments, and reducing unnecessary expenses.

Create posts that offer advice on managing finances during a crisis, like dealing with job loss, handling unexpected medical expenses, or responding to market volatility. Provide tips on where to seek financial assistance and how to access government programs or community resources.

Additionally, share stories of resilience and recovery from past financial crises, highlighting strategies that helped others regain their financial footing. This can offer hope and practical advice to those currently facing similar challenges.

20. Technology in Finance

The financial industry is rapidly evolving with the advent of new technologies. Keep your audience informed about the latest fintech innovations, such as robo-advisors, blockchain, and cryptocurrency. Social media post ideas for financial advisors can include explaining how these technologies can benefit individual investors and financial planning.

Create content that demystifies complex technological concepts, making them accessible to your audience. Share tutorials on using fintech apps and platforms, and discuss the potential risks and rewards associated with these innovations.

Highlight how technology can streamline financial management, enhance security, and provide new opportunities for investment and savings. Mobile banking and finance, digital wallets, consumer loan software, and other fintech solutions are transforming how individuals access and manage financial services. By staying ahead of technological trends, you can position yourself as a forward-thinking advisor in the financial industry.

21. Tips for Managing Financial Anxiety

Financial anxiety is a challenge many people face, especially when dealing with debt or uncertainty. As a financial advisor, offering solutions to reduce this stress is a great way to connect with your audience. Share practical tips like setting realistic financial goals, creating a budget, and developing an actionable debt repayment plan.

Incorporate breathing exercises, mindfulness techniques, and stress-reducing activities like setting up automatic payments to help them stay on track without constantly worrying. Videos or infographics that walk through calming strategies can be a powerful way to engage. Providing reassurance and practical tools will position you as a go-to advisor for fostering financial peace of mind.

22. Real Estate Investment Insights

Real estate is one of the most popular investment options, but it’s often overwhelming for beginners. As a financial advisor, you can break down complex real estate investment strategies into easy-to-follow tips. Talk about how to analyze rental property value, the benefits of buying versus renting, or how to leverage market trends.

Keep your audience updated on the latest market insights, including housing prices, interest rates, and the best times to sell. Use visuals like graphs or property images to make the information digestible. Sharing insights on tax benefits, tax credit, mortgage options, or portfolio diversification can further enhance your real estate-focused content, helping you stand out as an expert.

23. Personal Finance Tools and Apps

In today’s digital age, financial tools and apps have become essential for managing money effectively. Share posts that guide your audience through the best financial tools for budgeting, investing, or retirement planning. Highlight user-friendly apps like Mint, Acorns, or Robinhood that simplify everyday financial tasks.

Create short video tutorials or step-by-step guides explaining how these tools work, making them more accessible for your audience. Emphasizing the benefits of using financial apps to track expenses, save automatically, or invest without hassle will showcase you as a tech-savvy advisor who stays ahead of trends.

24. Sustainable Investing

Sustainable investing is a hot topic in the financial world, especially among younger, socially conscious investors. Explain what sustainable investing is, focusing on investments in companies with ethical, environmental, or socially responsible practices.

Create content that breaks down sustainable funds, green bonds, or renewable energy investments. Highlighting companies with strong environmental, social, and governance (ESG) practices can show how investors can align their financial goals with their values. By explaining potential risks and returns, you’ll help your audience make informed decisions while positioning yourself as an advisor who understands modern financial trends.

25. Emergency Fund Basics

An emergency fund is a crucial safety net, but many people are unsure how to build one. Use your platform to explain the importance of having at least three to six months’ worth of living expenses saved.

Offer strategies on how to start small and consistently contribute to an emergency fund, even on a tight budget. Real-life examples of how emergency funds helped others during unexpected expenses – like job loss or medical emergencies – can inspire your audience to prioritize this financial step.

26. Budgeting for Beginners

Budgeting is a foundational skill that many people struggle with. As a financial planner, you can simplify the process by sharing step-by-step guides on how to categorize expenses, track spending, and set savings goals.

Create downloadable budget templates or provide a list of common budgeting mistakes to avoid. Share examples of how budgeting can reduce financial stress and improve long-term financial health. Simplifying budgeting tips will help your audience see it as an essential tool rather than a chore.

27. How to Pay Off Student Loans Faster

Student loans can feel overwhelming, but sharing smart ways to pay them off can be a game-changer for your audience. Discuss the benefits of making extra payments when possible, refinancing for a lower interest rate, or consolidating multiple loans into one manageable payment.

Highlight how paying off student loans sooner can open up opportunities for other financial goals, like buying a home or saving for retirement. This type of content resonates well with younger audiences and positions you as an advisor who understands their unique challenges.

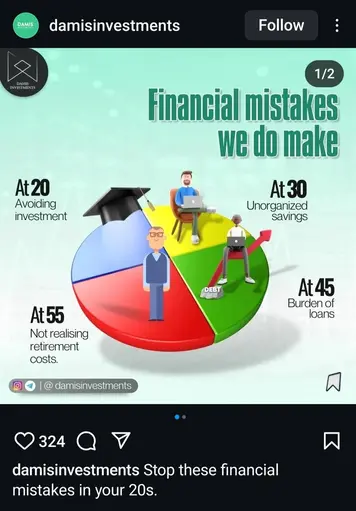

28. Financial Mistakes to Avoid

Everyone makes financial mistakes, but the key is learning how to avoid them in the future. Share posts about common financial missteps like overspending, neglecting savings, or failing to plan for retirement, or even mismanaging a small business line of credit.

Offer actionable advice on how to course correct, whether it’s reducing credit card debt, building an emergency fund, or sticking to a budget. Sharing personal anecdotes or client stories about overcoming financial mistakes can add a relatable and motivational touch to your content.

29. How to Plan for Big Purchases

Big purchases like homes, cars, or vacations require thoughtful planning. Create posts that walk your audience through how to save for major expenses without sacrificing their financial health.

Offer tips on cutting unnecessary expenses, setting clear savings goals, and using tools like high-yield savings accounts to maximize their funds. You can also discuss financing options, such as when it’s smart to take out a loan versus paying cash. This practical content can help your followers feel more prepared for life’s big expenses.

30. Building Wealth Over Time

Building wealth doesn’t happen overnight, but many people seek quick results. Create content that emphasizes the importance of patience and long-term thinking.

Share strategies like automating savings, investing in diverse portfolios, and staying disciplined in the face of market volatility. Use real-life case studies to show how slow and steady wealth-building pays off over time. This type of content can motivate your audience to stick with their financial goals and trust in the long-term process.

Modern financial advisors often prefer digital tools to improve client experience. A customized mobile banking app development solution can also help streamline processes and enhance trust.

Why Leveraging Social Media Post Ideas for Financial Advisors is Key

In the present time, professionals in various fields cannot do without social media. Financial advisors are among them who stand to reap great benefits from these digital platforms.

Though traditional networking and customer sourcing still have their significance, it is impossible to overemphasize the importance of making financial advisor posts on social media. The following are reasons why financial advisors cannot do without social media and how it can uplift their profession.

1. Establishing Trust and Credibility

Financial advisers can build trust and credibility with both existing and potential clients through social media.

Advisors are able to establish themselves as authorities in their industry by regularly posting valuable information like market insights, money-saving tips, or industry news. They can make their brand seem more human through engaging posts and conversations, thus creating real bonds with their target audience.

2. Expanding Reach and Visibility on Social Media Platforms

Social media offers financial advisors a platform to reach a broader audience beyond their immediate network. Social media platforms like LinkedIn, Twitter, and Facebook have billions of subscribers globally, and this gives advisors a golden chance to extend their reach and attract new clients.

By strategically using hashtags, joining relevant groups, and participating in industry discussions, advisors can increase their visibility and attract the attention of individuals seeking financial guidance.

3. Cultivating Relationships

Effective financial advising is not all about one-time transactions; it’s rather about developing long-term relationships that are founded on trust and understanding.

This means that social media management enables advisors to be in constant touch with customers by giving them continuous support and guidance. Social media post ideas for financial advisors can be developed around educational material, marking important events, or having casual talk sessions with clients, thus reinforcing their value proposition.

4. Showcasing Expertise and Differentiation

In a competitive industry, differentiation is key to standing out and attracting clients. Social media allows financial advisors to showcase their unique expertise, specialization, and value proposition.

By sharing case studies, client testimonials, and success stories, advisors can demonstrate their ability to deliver tangible results and solve complex financial challenges. Consistent branding and messaging across social platforms can further reinforce their unique selling points and set them apart from competitors.

5. Staying Current and Adaptable

The finance market is a constantly shifting landscape that is influenced by regulations, market trends, and economic developments. Social media networks act as live news feeds for financial planners to be aware of what is happening around them.

By staying current with industry conversations and participating in discussions, advisors can demonstrate their agility and adaptability in responding to changing market conditions. This makes them more credible and enables them to offer clients advice at the right time.

6. Compliance and Risk Management

Undoubtedly, social media usage among financial advisors has numerous advantages; however, it must still be done under regulatory compliance restrictions. When using social media for business purposes, financial advisors need to comply with various industry laws, including those set down by bodies such as FINRA and SEC.

Implementing comprehensive policies on compliance will help control risks arising from social networking, hence maintaining professional standards and client relationship management.

Wrapping It Up

In today’s digital age, social media platforms provide an unparalleled opportunity for financial advisors to establish and grow their personal brands. By implementing the social media post ideas for financial advisors discussed in this article, you will be able to enhance brand awareness and your page’s growth.

Focus on creating content that simplifies complex financial concepts, helping your audience make informed decisions. Moreover, if you want to streamline your content creation and social media marketing, checkout

FAQs

1. How do I advertise myself as a financial advisor?

To advertise yourself as a financial advisor, focus on building a strong personal brand. Share your expertise through blog posts, webinars, and social media content. Engage with your audience by answering questions and offering helpful advice. Networking through local events, online communities, and LinkedIn can also expand your reach. Consistent, valuable content establishes trust and authority in your field.

2. What should financial advisors post on LinkedIn?

On LinkedIn, financial advisors should post a mix of educational and industry-specific content. Share insights on market trends, personal finance tips, and case studies that showcase your expertise. Use LinkedIn to highlight client success stories and share updates about financial planning strategies. You can also post articles, infographics, or videos to engage with your professional network.

3. How do you compliment a financial advisor?

Compliment a financial advisor by acknowledging their expertise and the positive impact they’ve had on your financial goals. You can say things like, “Your advice has really helped me make better financial decisions” or “I appreciate how you simplified complex financial concepts for me.” Positive feedback reinforces the value they bring and strengthens the advisor-client relationship.

4. Can financial advisors post on social media?

Yes, financial advisors can post on social media, but they must follow industry regulations, such as compliance with FINRA or SEC guidelines. Content should be educational, offering value to their audience, while avoiding specific investment advice. Advisors can share financial tips, latest industry news, and client success stories to build trust and credibility. Social media also helps them reach a broader audience and engage with potential clients.