Customers do not come immediately after opening a business. It requires some amount of investment before expecting returns from the business. The total cost that is invested to acquire new customers is known as the Customer Acquisition Cost. Generally, this will involve the marketing expenses and the money spent in the sales process. CAC is crucial for understanding the efficiency of a company’s customer acquisition strategy and for planning future investments in marketing and sales.

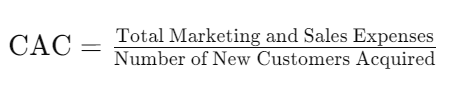

This can be easily calculated by the following formula –

For example, if you spent about 5000$ on marketing and sales in a month and acquired about 100 customers, then your customer acquisition cost is 50$.

Components of CAC –

- Marketing expenses – Costs related to advertising, content creation, social media campaigns, SEO, PPC (pay-per-click) advertising, events, and other marketing efforts.

- Sales expenses – Costs associated with sales staff salaries, commissions, bonuses, sales software, and other sales-related expenses.

- Operational expenses – Any additional costs that support the marketing and sales functions, such as overhead costs, technology, and infrastructure.

Importance of knowing CAC –

- This metric is highly essential in understanding how much investment is going into acquiring new customers. For example, it can be compared with lifetime value to see which is higher. If CAC is higher, then you are investing more in acquiring new customers than focusing on customer retention.

- Furthermore, the knowledge of this cost will enable budgeting based on the data. Companies will be able to focus more on cost-effective methods of acquiring new customers by comparing the options available.

- Understanding CAC is essential for planning and scaling a business. As a company grows, the cost of acquiring each new customer can change. Tracking can help businesses anticipate changes and adjust accordingly.

- This metric when combined with other metrics provides a comprehensive picture of a company’s financial health and operational efficiency. This will help retain investors in the long term if CAC is kept low.

- By analyzing CAC, businesses can identify which marketing and sales strategies are most effective and which ones need improvement.

- Accurate monitoring of acquisition costs can enable forecasting revenue. This will help in understanding how much is invested in acquiring customers and how much profit is made.

- This acts as a benchmark to retain more customers rather than spending more on acquiring new customers.

- CAC also helps in long-term decision making such as entering new markets, launching new products, or adjusting pricing models.

- It will also compare self-metrics with competitors or industry standards.

Summary –

Unlike lifetime value, CAC depends on marketing alone and can be a very resourceful metric in understanding when to focus on marketing and when on customer retention. The importance of measuring and tracking this metric is to analyse profit, initiate budget allocation, retain investors, and help in marketing decisions, revenue forecasting and performance benchmarking. CAC can be reduced in multiple ways by improving marketing strategy, leveraging customer referrals and social media marketing tools and focusing on customer retention. Overall, companies should focus on the measurement of acquisition costs on a regular basis to make necessary changes.